Dr. Kapital Question Time: Re The Magic Freigeld

Dear Doctor Kapital,

This seems right up your alley, and it has all the marks- get it?- of great economic anecdotes.

Great Depression. ☑

Subversion of Monetarist Norms. ☑

Keynes quote. ☑

Arcane German Names. ☑

Romantic Crushing by External Forces of Successful Radical Social Experiments. ☑

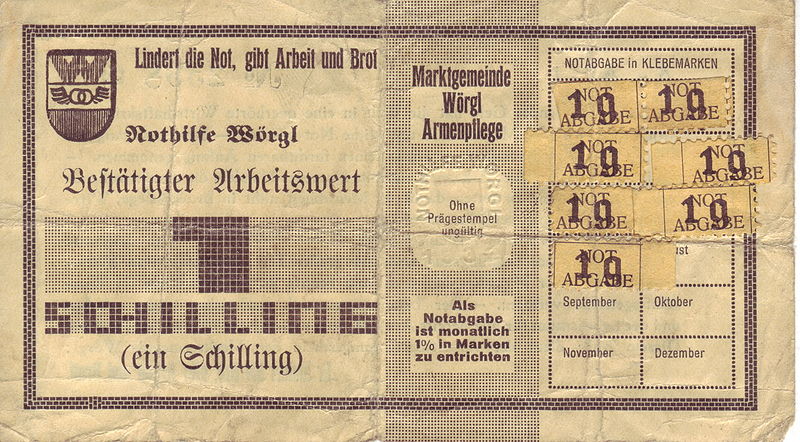

A Mysterious and Compelling Document with Gothic Lettering. ☑

The question is: why not the Freigeld, a currency which loses its value over time in a controlled manner? The incident in question was in Worgl, Austria in 1933, when as a desperate measure in the Depression and collapsing national currency, the Mayor by the unimpeachable name of Michael Unterguggenberger, issued the Freigeld. Legend has it that everything got better. Everything.

From the wiki on demurrage..

This led some such as German-Argentine economist Silvio Gesell to propose demurrage as a means of increasing both the velocity of money and overall economic activity. On the other hand, influential British economist John Maynard Keynes contended that Gesell's proposed demurrage fees could be evaded by the use of more liquid competing forms of money and that therefore inflation was a preferable method to achieve economic stimulation.[2]

So, was Keynes right or wrong?

4 Comments:

Why would I spend money if it gained value while I hold onto it? (Hint: I wouldn't.)

I have texted Dr. Kapital twice, but no response yet. Sometimes takes awhile.

Rumors that he has been walking around Piccadilly Circus wearing nothing but Google Glasses and a bowler hat are probably not true.

While we wait: I had a Japanese colleague who studied this history pretty carefully. He said these local currencies (there were several) sometimes had positive effects. This paper looks interesting:

link

Fascinating- And it mentions a scrip in Norfolk, NE. My dad may well have used this scrip during the 30s in high school (where Johnny Carson went as well).

So what about modernizing? A credit-card based scrip: a standard plastic social capital/ scrip time/stamp card, could be programmed with finely tuned, and even adjustable incentives, managed perhaps by a local credit union, and backed, perhaps by local credit union loans; far more certain, if memory serves, than large banks.

We might create a highly adaptable, modern localized monetary policy, as a strong corrective to the heavy economic impacts of the concentration of capital; imagine many dying small towns without access to credit, or even cities like Detroit, creating their own scrip currencies.

(PAUSE)

They're going to come and arrest me now, aren't they?

Post a Comment

<< Home